In recent developments, the U.S. government has unveiled a set of new tax regulations aimed at digital assets. As per the proposal by the Internal Revenue Service (IRS) on August 25, brokers involved in cryptocurrency transactions will now adhere to revised rules, which include using a redesigned form, to facilitate transparent tax filings and deter dishonest practices.

The move, as explained by the U.S. Department of the Treasury, is an effort to bring parity between reporting procedures for digital assets and other financial instruments.

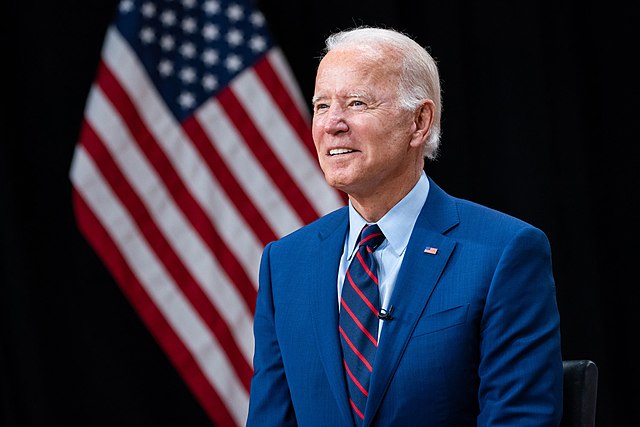

However, this decision hasn't resonated well with everyone in the crypto world. Many feel these rigid guidelines could potentially deter the growth of the cryptocurrency sector within the U.S. Ryan Selkis, the chief at Messari, hinted at possible stunted growth for the U.S. crypto scene, especially if President Biden clinches a second term.

The wider sentiment seems to lean towards a sense of skepticism, with concerns raised about both major political parties in the U.S. and their potential roles in championing or sidelining crypto initiatives. One particular commentary underscored the worrisome privacy implications of these new regulations, stressing the U.S.'s historical stance on income tax and its implications on the acceptance of private transactions.

Additionally, the Biden administration has previously shown an inclination towards curbing crypto activities. A notable suggestion from earlier this year was to levy taxes on digital asset mining, citing environmental reasons. This March 9 suggestion considered an excise tax pegged to the energy consumption of digital asset mining operations.

Regulatory decisions continue to be a sore point for the U.S. crypto community. A case in point was Michael Sonnenshein of Grayscale Investments' assertion on August 13, warning of possible relocations by crypto firms due to aggressive regulatory stances by institutions like the Securities and Exchange Commission.