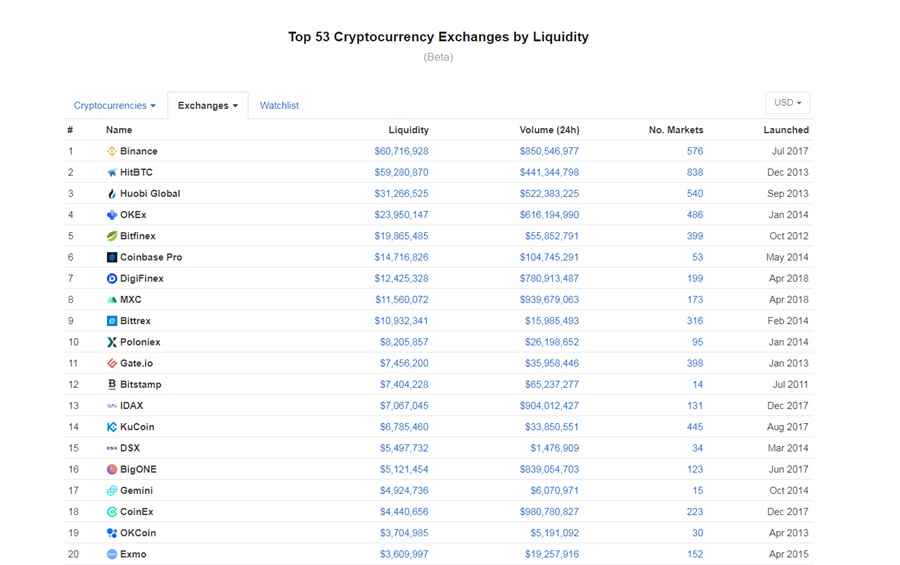

CoinMarketCap, one of the most popular sites for tracking the activity of cryptocurrencies and crypto exchanges, just released a new metric.

Called the CoinMarketCap Liquidity, the metric will allow comparing cryptocurrency exchanges and currency pairs on the basis of liquidity. CMC said that this part of its efforts to fight the issue of inflated trading volumes across the industry

The new tool will be analyzing 3,000 crypto assets and calculate the score based on a multitude of factors including order sizes, distance from the mid-price, and several more.

CoinMarketCap Chief Strategy Officer Carylyne Chan explains that orders that drastically diverge from the average price are likely coming from the operator itself to boost volume numbers. If this occurs, the tool will rank that exchange a lower liquidity score.

Reported Volume in CoinMarketCap is no longer useful

“When people are inflating their volumes, they are basically inserting orders into the order book, so they buy and sell to themselves. What we are trying to do here is to counter that,” Chan said.

Chan added that the Reported Volume metric has lost its value due to some exchanges boosting their own trading volumes. Putting this into practice, the disparity is indeed significant, Cointelegraph reported.

Liquidity over reported volume

For instance, at the time of this writing, BitMEX is sitting at the number one spot on the Reported Volume metric with a $1.6 billion trade in the last 24-hours. Switching at the Liquidity metric, however, and Binance jumps at the top despite the Malta-based crypto exchange platform reporting a trading volume of $850 million. Through this new tool, Chan aims to encourage people to put more weight on the Liquidity metric and ditch the Reported Volume.

“Today, we are introducing a new metric to highlight what matters most to investors and traders: liquidity. With our Liquidity metric, we hope to provide public good to the crypto markets by encouraging the provision of liquidity instead of the inflation of volumes,” Chain said.

The Liquidity tool comes nearly a month after CoinMarketCap launched a page that provides data on cryptocurrency interest rates. The page aims to help people identify and compare products, which can beneficial for anyone who is into crypto hedging and margin trading, The Block reported.

Comment 25